(VOVWORLD) - In the escalating trade war between the USA and China, ‘critical minerals’ and especially rare earth minerals (REM) have again become a prominent issue. This is because trace quantities of these minerals are used in products and applications across the petrochemical, electronics, clean energy and defence sectors.

Dr Michael Spann

School of Political Science and International Studies, University of Queensland and Square Circle Global Development. |

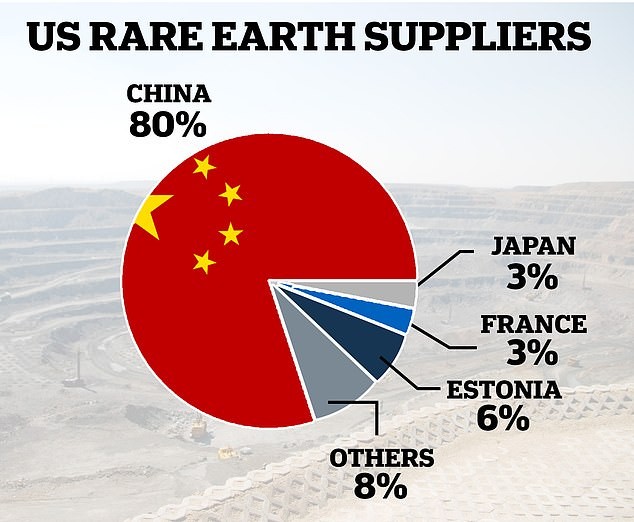

As substitutes for REMs range from none to few, they are considered to be ‘critical’ and ‘strategic materials’ as they play a vital role in economic prosperity and national defence. In the case of the USA, these materials which have been identified as being essential for its national security and the continued functioning of its industrial ecosystems, are primarily acquired by imports from China. Hence, any perceived disruption tosupply chains sends alarm bells ringing. This has certainly been the case recently with Chinese media suggesting that in response to the USA’s moves against Huawei, high end finished products using rare earths could become part of Chinese export restrictions. This was on the heels of a much-publicised visit to a rare earths industrial complex by Chinese President Xi Jinping where he called for a new ‘Long March’. This was interpreted as China warning the USA that it would use its overwhelming dominance in REMs to leverage strategic advantage in the trade war. This has raised geopolitical tensions with REMs potentially being used as a ‘resource weapon’ or where a producer state reduces supply and sale of critical materials and minerals to get the other party to change their policies (O’Sullivan 2013). Of course, ‘the resource weapon’ has more power when there is a dependency on a particular supplier, much like there is with the USA’s dependence on China with REMs. This dependency was recognised by the American Security Project back in 2011 who warned, “ […] The US has been particularly lax when it comes to securing the supply of these metals (REMs) […] China’s dominance in the rare earth’s market will have profound implications for US National Security in the next couple of years. The US needs to take steps now to remedy this situation.” The same is being said, albeit with heightened geopolitical tension in 2019.

History, diplomatic coercion and rare earths

It is somewhat ironic that the USA up until the end of the Cold War was the dominant global supplier ofREMs. However, following the Cold War, funding and technical assistance from the US government for its domestic REM industry was taken away and this had the effect of making the US REM suppliers not economically competitive with their Chinese competitors. Mines and production facilities closed and by 2002 China had become the dominant supplier, fulfilling the recognition of their importance by Deng Xiaoping who stated in 1992, “the Middle East has oil, China has rare earths.” This dominance was aided by certain factors. Firstly, the spike in global demand for consumer electronics and clean energy technology, both of which used REM products. Secondly, China’s less stringent environmental safeguards facilitated production as rare earth extraction and processing is known for enabling serious ecological concerns such as surface water being contaminated through toxic run off, crop failures, topsoil erosion and pollution (Ali 2014). Thirdly and crucially, China increasingly began to take control of the value-addprocess by manufacturing rare earth products so that now approximately 80 % of rare earth production is by China. This last factor enables REMs to become more of a resource weapon in efforts of diplomatic coercion.

|

This was certainly the case in 2010 when the enflaming of the Senkaku/Minjinyu territorial dispute between Japan and China and subsequent diplomatic crisis brought the use of REMs as a ‘resource weapon’ to the forefront. China suspended shipments of REM products to Japan, which as the world’s largest consumer of REMs, felt that this threatened its industrial ecosystem that is based on high end manufacturing. This prompted not only Japan but also the USA and the EU to undertake legal action through the World Trade Organization (WTO). Japan and the USA also sought to find new non-Chinese suppliers. The USA reopened their largest REM facility, the Mountain Pass Mine that had closed after the end of the Cold War although its output still had to be processed in China, another ironic situation that continues to this day! Amongst other countries like Kazakhstan and Australia, Japan also signed an agreement with Vietnam to develop joint exploration rights and secure the rights to REM reserves. On the legal front, Japan, the EU and the United States started proceedings at the WTO against Chinese restrictions on REMs in 2012. China asserted that its restrictions were to protect the environment and that restrictions were part of its continued crackdown on unregulated mines and rare earth smuggling. In 2014, the WTO found against China and this decision was subsequently upheld after a Chinese appeal (Wilson 2018). However, whilst the US government in 2017 identified international trade agreements such as the WTO as being important to ensure national security is not threatened by import reliance on critical minerals, it is becoming difficult for the USA to maintain this stance. This is because the Trump administration consistently flouts the rules surrounding the multi-lateral trading system and has a stated disregard for the WTOs dispute settlement system. With the increasing nationalist and protectionist policies emanating from Washington, some analysts are suggesting a ‘zero-sum’ conflict is building with a cold war style either/or scenario emerging, once again placing emphasis on military/arms build-ups and bolstering and expanding spheres of influence.

Military security, Rare earths and spheres of influence

With a feeling that military conflict stemming from ‘great power rivalry’ is unfortunately back on the table, REMs also figure into this equation. However, it is not the REMs themselves which worry officials at the Pentagon but the highly processed REM products such as permanent magnetsthat are vital to missiles and missile tracking systems, sonar and radar devices, avionics systems for aircraft, laser targeting systems and other components of advanced military technologies and weapons systems. A case in point is the Tomahawk missile, which is one of the most used weapons by the US military but are rendered useless withoutcritical minerals from China. Indeed, it is the potential disruption to the defence material chains that supply the military-industrial complex that is of the upmost importance to the United States. Quite simply, in the case of a military or economic conflict China could conceivably hold back suppliesthus severely damaging military capabilities. Indeed, during the previous use of REMs as a weapon of diplomatic coercion in the WTO affair, the United States Department of Defence (DOD) found their defence supply chain to be dangerously dependent on Chinese REMs and put in measures such as stockpiling military essential REMs and rationing military essential REMs in case of supply disruption with China (Wilson 2018). Nevertheless, this military stockpile is seen to be inadequate and recently the DOD has asked the US congress for funding to strengthen domestic production of REMs. This strengthening of the domestic industry starts from a low baseline though with the Mountain Pass Mine (which had been closed again after the settling of the WTO REM crisis) the sole operating REM facility in the USA and as previously mentioned, its production must be sent to China for processing. Whilst other facilities are slated to begin construction and come on line, the USA is trying to secure future production of REMs by looking further afield to set up ‘pipeline projects’ in ‘third countries’ to weaken China’s position over future production.

|

This is because REMs, despite the name are not, geologically speaking, especially rare and reserves are found across the globe and can at current consumption levels last for approximately 1000 years. With these reserves and the fact that the next generation of military technology will be even more reliant on critical minerals it is easy to see why cold war type manoeuvring through ‘spheres of influence’ comes into play. For example, Australia, which is the second largest REM mining country behind China has been enlisted to try and bolster supply to not only the US but also other allies like Japan, South Korea and Canada. These allies defence capabilities also rely to a certain extent of US military technology that is once again becoming more important in the tensions surrounding the emerging Indo-Pacific security order. However, in the short term, the introduction of new suppliers will be not be able to weaken China’s dominant position. This is because the mining and refining of rare earths is technically challenging with facilities taking years to be built. This is compounded by the rarity of downstream processing facilities in order for REMs to be turned into products. In short, constructing integrated value chains (mining, separation and processing) is a medium to long term goal to dilute China’s near monopoly. Indeed, it is these longer time periods for REMs to enter consumer and military supply chains that lead some analysts to believe that China will use REMs as diplomatic coercion in the short term as they can see their dominance becoming less over time. This diplomatic coercion would, of course, also cause ‘collateral disruption’ to allies and trading partners. Returning to the theme of ‘spheres of influence’ both the USA and the China are looking to extend theirs and this extension can come especially though the upstream mining stage. As mentioned previously, REMs are not particularly rare and thus the USA has been looking beyond its traditional Indo-Pacific allies to diversify away from China. Thus, the US DOD has been active recently in Africa trying to make connections with potential suppliers and ascertain sites for potential exploration as, generally speaking, Africa does not hold much collected data on REMs. Such manoeuvres may also bring more flashpoints between China and the USA into play as China has been very active in parts of Africa over the last 15 years and may see its position being challenged through the USA’s renewed interest in REMs. This challenge may be compounded by the fact that China, whilst having the largest global reserves of REMs, is also looking to secure more of its supplies from overseas. The reasons for this are two-fold. Firstly, as stated previously the extraction of REMs can be damaging to the environment and China has taken steps to externalise some its ecological burdens connected with REM supply by shutting unlicensed mines and engaging in rehabilitation efforts. Secondly, China is looking to increase its advantage in downstream processing as this is where the money and power ultimately lies. Thus, it is putting more of its resources into this downstream stage letting other countries do the dirtier, less profitable work upstream at the source.

(Source: dailymail.co.uk) (Source: dailymail.co.uk) |

Conclusion

Like most aspects of the currentrelationship between China and the USA, the situation regarding REMs is fluid and complex and this article can only offer a brief overview. What is clear however is that REMs cannot be siloed off from other issues concerning the growing great power rivalry between China and the USA. Indeed, as this article has shown, REMs may be used as a weapon to facilitate diplomatic coercion in other issues, whether that is tension surrounding Huawei and the roll out of 5Gor territorial disputes in the South China/East Seas. For Vietnam, which entered the REM industry in the wake of the WTO dispute between Japan and China and has the second largest reserves of REMs globally (tied with Brazil) there is an opportunity to continue to expand its industry from the 400 tons of production in 2018 (this was double the previous year). However, this expansion could come with a couple of choices. Firstly, to whose sphere of influence to commit as REMs will play a pivotal role in not only the next generation of military hardware but also the technology needed to become integrated into the Fourth Industrial Revolution. Secondly, Vietnam will have to decide how much of its REM expansion and investment is for domestic use in order to build its clean energy initiatives for a low carbon future.

This article is written exclusively for VOV5 and Song Viet - VOV. Any unauthorized use is prohibited.

References

Saleem H. Ali (2014). Social and Environmental Impact of the Rare Earth Industries, Resources, 3, 123-134.

Meghan O’Sullivan (2013) “The Entanglement of Energy, Grand Strategy and International Security,” in Handbook ofGlobal Energy Policy, edited by Andreas Goldthau (Chichester, UK: Wiley-Blackwell), 30–47.

Jeffrey D. Wilson (2018) Whatever happened to the rare earths weapon?Critical materials and international security in Asia, Asian Security, 14:3, 358-373.